The sparsity of farmland in northern Australia is testament to the historical challenge in establishing new intensive agricultural enterprises and industries in this region. There are three main facets to this challenge, all of which need to be met for investments in northern agriculture to succeed:

- Markets: Where is the investor going to sell their produce and how are they going to set up the supply chains to get their products, at low-enough cost, to those who want to buy them?

-

Production Systems: What is the investor going to grow and do they understand how this needs to be grown differently in tropical Australia to where they have gained their previous experience?

- Competition: Why is it better to grow the chosen product in tropical Australia, relative to alternative options of growing the same product elsewhere, or another product in the selected location?

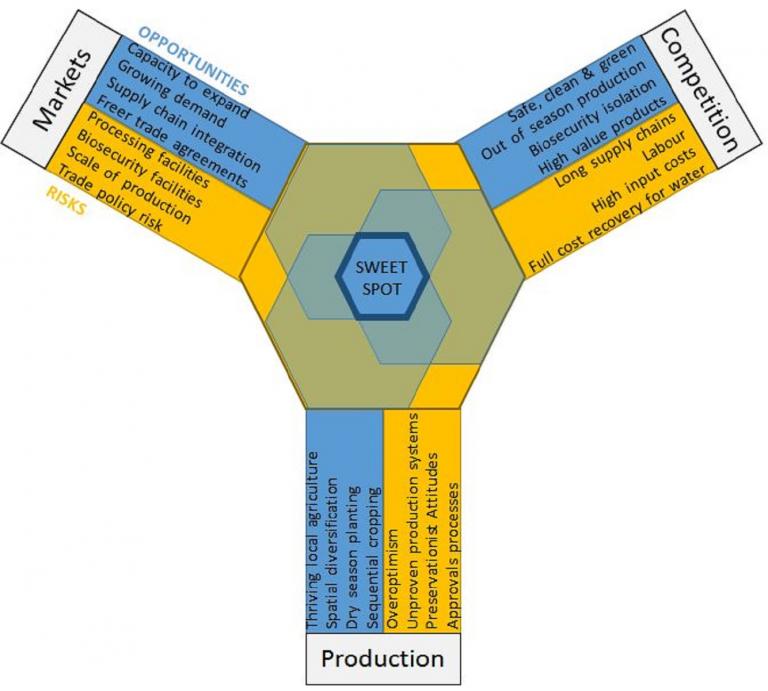

Successful investments have typically been able to address all three of the above criteria, while failures can usually be ascribed to shortcomings in one of more of these areas. Lessons can be learned from past successes and failures, together with technical evaluations of future potential options. There is substantial information on these topics from recent assessments, some of which have already analysed and integrated large amounts of data, but most of this work has tended to emphasise one or two facets. This case study (Agricultural Investment case study) integrates that information across all three facets to help evaluate and identify the combined sweet spot for viable investment opportunities and reduce associated risks.

The approach taken here was to synthesise information from key literature covering markets, agricultural production and relative competitiveness for new intensive agricultural development in northern Australia. From this literature four key opportunities and four key risks were identified for each of the three facets, as shown in the following diagram. The challenge for investors is identifying and crafting businesses cases that hit the sweet spot of addressing all these issues at the same time.

The table below expands on each of the opportunities and risks identified in the diagram. More detail on methods is provided in the accompanying Methods Report (Stokes et al. 2019)

| MARKETS | PRODUCTION SYSTEMS | COMPETITION |

|

Where is the investor going to sell their produce and how are they going to set up the supply chains to get their products, at low enough cost, to those who want to buy them? |

What is the investor going to grow and do they understand how this needs to be grown differently in tropical Australia to where they have gained their previous experience? |

Why is it better to grow the chosen product in tropical Australia, relative to alternative options of growing the same product elsewhere, or another product in the selected location? |

|

OPPORTUNITIES/STRENGTHS |

OPPORTUNITIES/STRENGTHS |

OPPORTUNITIES/STRENGTHS |

|

Capacity to expand |

Thriving local agricultural industries |

Safe, clean and green produce |

|

Northern Australia is relatively un-developed with capacity and natural resources to expand |

Intensive agricultural businesses, including in the agriculture services sector, are growing and maturing the Darwin region |

Gives access to markets with high health and environmental standards that some competitors are unable to meet. Also meets consumer preferences in some markets. |

|

Growing demand, particularly from Asia and Middle East |

Spatial diversification |

Timing of seasonal production |

|

A recent market analysis identified 18 products in demand that northern Australia could produce from horticulture, field crops and perennial trees/vines, including cotton, sorghum and sesame seeds |

More uniform supply of agricultural products by offsetting year-to-year variability in climate (floods, destructive winds, drought, temperatures, climate change), for example offset concentration of banana production in north east Queensland (~90%) |

Out of season production (relative to rest of Australia), broadens national seasonal supply and can provide price premiums for local produce, for example early season mangoes from Darwin |

|

Production system/supply chain integration |

Dry season planting allows better seasonal planning |

Biosecurity advantages of isolation |

|

Opportunities to integrate agricultural production systems and supply chains with other regions/countries (for example live export of cattle to south east Asia for fattening and supply chains with little and unreliable refrigeration: cold chain integrity is required to maintain quality of fresh and short shelf-life products) |

Planting at end of wet season in the north (vs start of wet in south) allows better seasonal planning (available soil & stored water are known at time of planting) |

Remoteness from other areas growing the same crop reduces the risks of spreading pests and diseases between them, for example Panama TR4 fungus in Cavendish bananas |

|

New freer trade agreements |

Sequential cropping |

High value horticulture & aquaculture |

|

Opportunities in 11 markets from free trade agreements, including recent agreements with Indonesia and the Pacific Agreement on Closer Economic Relations (PACER) |

Advantage of tropics is LENGTH, not ‘QUALITY’, of growing season; sequential broadacre cropping systems can make use of the longer seasons, but require tuning to local conditions (for example Cerrado in Brazil) |

Proportionally less affected by higher costs of remoteness, and better suited to niche, small-scale, localised opportunities |

|

RISKS/WEAKNESSES |

RISKS/WEAKNESSES |

RISKS/WEAKNESSES |

|

Processing facilities |

Greenfield risks (overoptimism) |

Length and quality of supply chains |

|

Processors require assured scale & reliability of primary produce for investment in new processing infrastructure to be viable |

An entrepreneurial spirit is required, but enthusiasm can exceed capacity and planning, e.g. underestimating development costs and time required to learn and adapt to local greenfield conditions, and overestimating farm production and gross margins |

Higher transport costs and spoilage overall resulting from large distances to market and poorer quality of many regional roads and some storage/processing facilities. Lack of export facilities and established freight networks into international markets. |

|

Biosecurity facilities for export |

Approvals processes |

Labour availability and capacity |

|

To meet quarantine requirements and certification for some target markets (for example irradiation of mangoes). As with processing facilities, requires assured scale & reliability of primary produce |

Approvals processes can be protracted, costly, poorly-coordinated and lacking in clarity - a definitive decision in a reasonable time-frame, either way, provides investors with certainty and allows Government to better direct its resources to supporting more promising options |

Intensive production has high, seasonal demands for labour relative to local population, for example demand in peak week of mango fruiting requires equivalent of ~2% of resident working population in Darwin study area |

|

Scale of production |

Unproven production systems |

High input costs |

|

Chicken & egg - need to achieve scale of production to cover required infrastructure costs & establish new markets, but hard to scale production efficiently until that infrastructure is built |

Novel elements are required to enable and adapt production systems for the particular challenges of northern agriculture for example tropical vs subtropical agronomy, sequential cropping, variability in climates and prices, and biosecurity |

Input costs are high relative to competitors (generally Australia vs international, and remote Australia vs closer to local markets and labour sources) |

|

Trade policy risk (market access) |

Preservationist public attitudes |

Full cost recovery for new infrastructure |

|

Access to foreign markets can become more restricted, for example live cattle export restrictions |

The social licence to develop may be lacking due to attitudes from intensively-developed parts of the south inappropriately exported and applied to the sparsely developed north (intensive agriculture occupies only 0.02% of land in tropical Australia west of the Great Dividing Range) |

Challenging for new irrigated development to compete on basis of full-cost recovery for water and other infrastructure against existing developments where off-farm capital costs were subsidized |

Substantial data collection, integration and analysis had already been done on these topics recently and was not repeated here. Rather this case study (Agricultural Investment case study) aimed to integrate the finding across those topics to gain insights from this combined overall view of bottlenecks for investment in northern Australia agriculture, and how they might be addressed.